The Of Federated Funding Partners Legit

Table of ContentsThe Of Federated Funding Partners LegitRumored Buzz on Federated Funding Partners LegitThe smart Trick of Federated Funding Partners That Nobody is DiscussingFederated Funding Partners - TruthsThings about Federated Funding Partners Reviews

16 a month for 24 months to bring the equilibrium to zero. This works out to paying $2,371. 84 in interest. The monthly financial savings would certainly be $115. 21, as well as a financial savings of $2,765. 04 over the life of the loan. Also if the regular monthly payment remains the very same, you can still appear ahead by simplifying your financings.73($ 1,813. 91 * 3) $1,820. 22($ 606. 74 * 3) $20,441. 73 $16,820. 22 Nonetheless, if you transfer the equilibriums of those three cards right into one combined funding at a more affordable 12% rate of interest and you proceed to pay off the lending with the very same $750 a month, you'll pay roughly one-third of the passion$ 1,820.

This totals up to a total cost savings of $7,371. 51$ 3,750 for settlements as well as $3,621. 51 in interest.

Have you maxed out your charge card? Are you battling to repay money you've borrowed!.?.!? Paying off that brand-new car in the driveway? Balancing all of your financial obligations can be an examination of your multitasking skills, and also your peace of mind. By consolidating your debts, you can make your life much easier as well as begin living debt-free.

Fascination About Federated Funding Partners Reviews

The advantages of financial obligation loan consolidation do not finish there: Financial debt combination financings are billed at a much reduced price than all of your private lendings or financial obligations, such as hire purchases or credit scores cards. The typical New Zealander is currently strained with record levels of debt. Possibilities are, you're one of them - federated funding partners bbb.

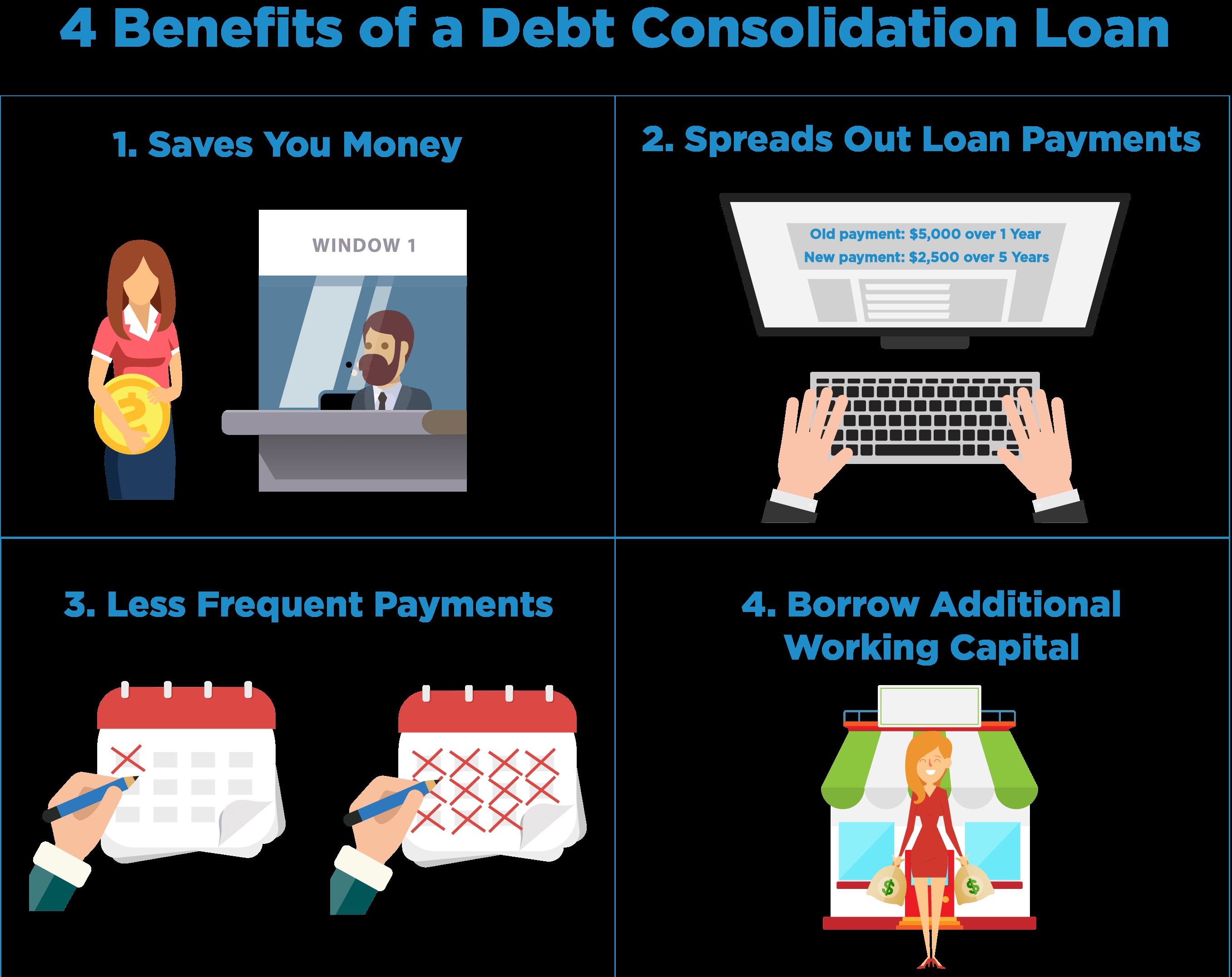

Some of your financings may be due by the end of the month. Others, 6 months from currently. Either method, they can be challenging to monitor. A financial debt combination finance makes life very easy, offering you just the one month-to-month settlement as well as a settlement term that is typically a lot longer than your existing financial debts.

It's simple to forget a settlement when you're so hectic. The resulting late fees, charges, as well as possible durable marks versus your credit report are an unnecessary problem. With simply the one car loan?

The Best Guide To Federated Funding Partners Bbb

Your finances as well as debts are all taped in your debt report, which is where your credit history originates from. Paying off your financial debts with a financial obligation consolidation loan will certainly mark these as paid on your credit rating record, which will enhance your credit scores rating by showing that you're a responsible debtor that can meet their month-to-month repayments.

Emergency expenditures and considerable bank card usage can land you in a sticky economic circumstance where you're left paying high-interest prices on all forms of financial obligation. In this case, debt combination can be a sensible option to assist try the debt and potentially pay it off sooner. Here are just a couple of benefits of the financial debt consolidation process.

Settle High Passion Charge Card Balances Many credit scores cards make use of rotating financial debt. This implies you can utilize as much or as little of limit quantity established by the charge card business. While it's great to have that versatility when you require access to credit score, many find it hard not to overspend and fall into huge charge card financial obligation.

This type of funding is thought about an installation finance. By moving your credit report card debt to an individual finance, you'll be able to pay it off rapidly and also save in life time rate of interest.

Federated Funding Partners Bbb for Dummies

Prices vary, are subject to change, as well as are based on specific credit rating value. Price quoted is based on A+ credit history ranking. Settlement example: A debt consolidation financing of $10,000 for 60 months at 5.

What's more, taking out a financial debt loan consolidation financing will certainly typically imply you have longer to pay. Your settlement period might be much longer you'll might still conserve money, as interest will usually be reduced as well as you won't be accruing any kind of more interest on your existing financial debts.

With a financial debt combination car loan, the total passion you will pay will certainly commonly click here for more info be decreased versus what you would certainly pay on charge card. While you ought to check the passion rate of a financial debt combination lending prior to applying for one, it might be a service that can lead to cash savings. This is absolutely true if you deal with a scenario comparable to the one above, where you're monetarily 'treading water' and also doing no greater than repaying the passion every month.

10 Easy Facts About Federated Funding Partners Bbb Explained

While you need right here to check the rate of interest of a debt loan consolidation funding prior to applying for one, it may be a remedy that can lead to money cost savings." 4. Aid with Your Credit history The most convenient way to take a look at this is to envision you proceeding with your existing financial circumstance versus getting a financial obligation loan consolidation car loan.